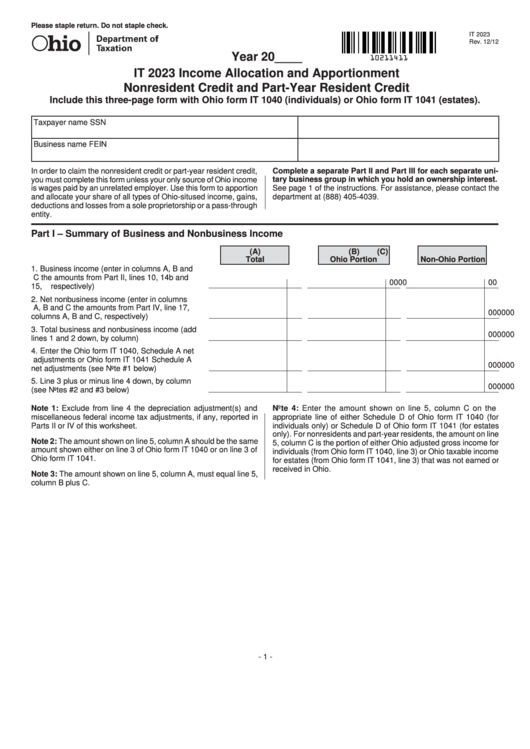

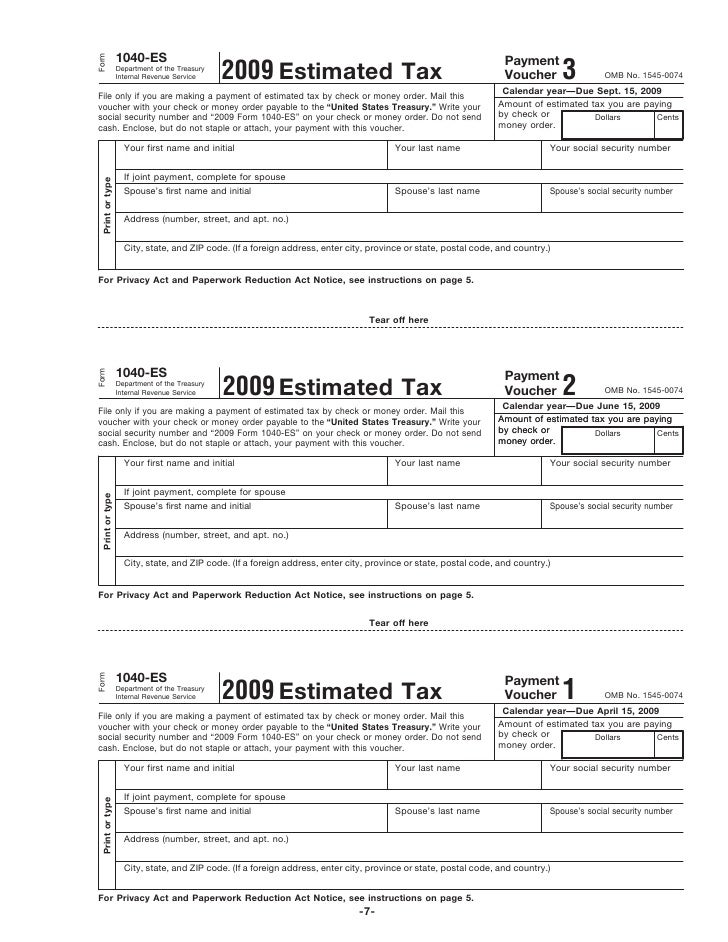

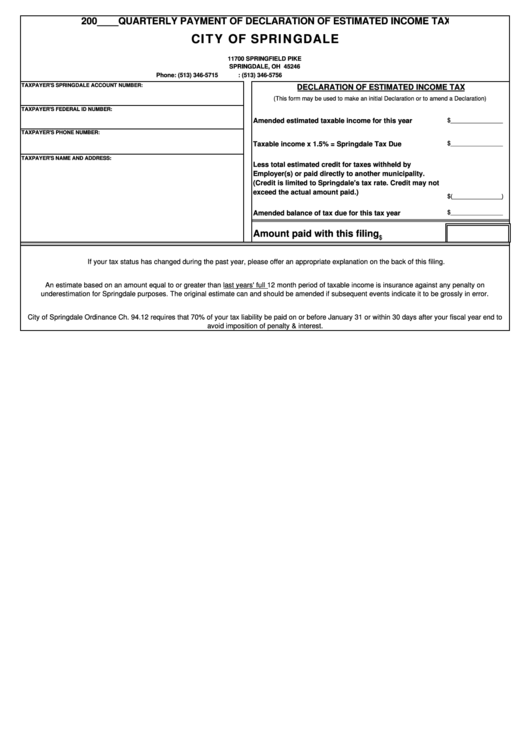

Irs 2025 Estimated Tax Payment Forms - 2210 Form 2023 2025, Final payment due in january 2025. First estimated tax payment due. Department of the treasury internal revenue service.

2210 Form 2023 2025, Final payment due in january 2025. First estimated tax payment due.

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, Here are some tips to navigate it. What is the purpose of estimated tax payment.

Capitals Development Camp 2025. Not only will the washington capitals be turning its focus to […]

Ciara Net Worth 2025 Forbes. Dare to roam, which makes travel accessories, r&c fragrances, lita […]

Federal Tax Forms 2023 Printable Printable Forms Free Online, First estimated tax payment due. The final payment is due.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Extension for filing individual income tax return; Best tax software for small business.

IRS Estimated Taxes Tax Withholding Estimator 2025, Final payment due in january 2025. Payment voucher with instructions and worksheet for individuals sending check or money order for any balance due on a form 502 or form 505, estimated tax payments, or.

2025 Form 1040 ES Estimated Tax For Individual Free Download 1040, The final quarterly tax payment for 2023 was due by jan. What is the purpose of estimated tax payment.

Federal Benefits Payment Irs 1040es Online Payment, Solved•by turbotax•2376•updated 3 weeks ago. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • october 19, 2023 8:10 am.

North carolina estimated tax payments Fill out & sign online DocHub, There are four payment due dates in 2025 for estimated tax payments: First estimated tax payment due.

The remaining quarterly payments are due. First estimated tax payment due.